Sep 2024

Comparison of the energy market between France and Italy: challenges and perspectives

The energy market is currently at the heart of global economic and ecological concerns, particularly in Europe, where the energy transition and the reduction of CO2 emissions play a crucial role. In this context, France and Italy, two of the continent’s main economies, follow different strategies to ensure their energy supply and achieve the decarbonization goals set by the European Union.

Introduction

As the Enlit Europe forum in Milan approaches, where the major energy challenges will be discussed, this article offers a comparative analysis of the energy markets in France and Italy. Datanumia, a key player in the energy transition, is participating in this key event by focusing on crucial concerns to build a greener and more sustainable Europe.

Similar historical market dynamics

The French and Italian energy markets share a common history marked by the nationalization of their energy infrastructures after World War II. For several decades, both countries maintained tight control over prices and production through state-owned companies.

Since the 2000s, under the impetus of the European Union, market liberalization has transformed this sector by opening the door to increased competition. New suppliers have emerged, further diversifying the offers and options for consumers.

Powerful energy players

Although market liberalization has paved the way for greater competition, the energy sectors in France and Italy remain largely dominated by historical players.

In France, EDF and Engie maintain dominant positions. EDF mainly relies on nuclear power plants to maintain its leadership, while Engie stands out thanks to its expertise in natural gas and renewable energies. It is interesting to note that EDF is also a key player in Italy through its subsidiary Edison, which focuses on renewable energy projects, particularly wind and solar.

In Italy, the leaders are Enel and Eni. Enel is the leading electricity producer and is heavily invested in the development of renewable energies. Eni, on the other hand, remains a global reference in the natural gas sector. It is also an important alternative supplier in France, illustrating the energy interdependence of both countries.

Energy mix: contrasting strategic choices

One of the main differences between the French and Italian markets lies in their energy mix. In France, nuclear energy plays a predominant role, representing about 65% of electricity production. This strategic choice, initiated in the 1970s, allows the country to maintain one of the lowest CO2 emission rates per kilowatt-hour produced in Europe. The challenge for France is to strengthen its decarbonized energy mix by combining nuclear power with more renewable energies, which already accounted for about 26% of electricity production in 2022.

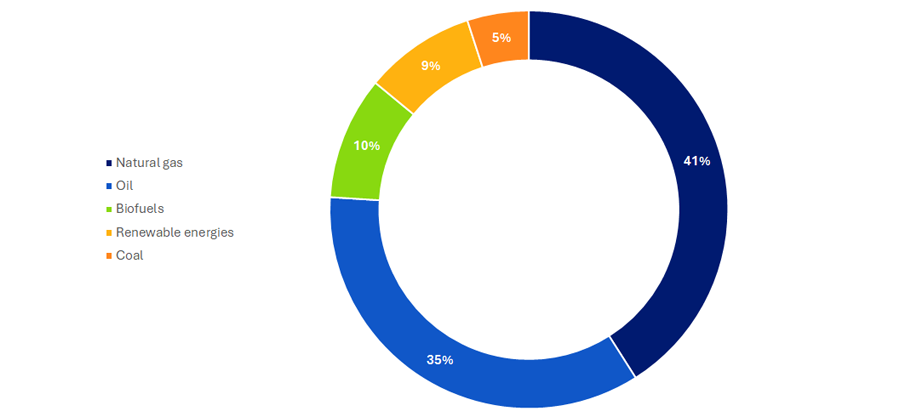

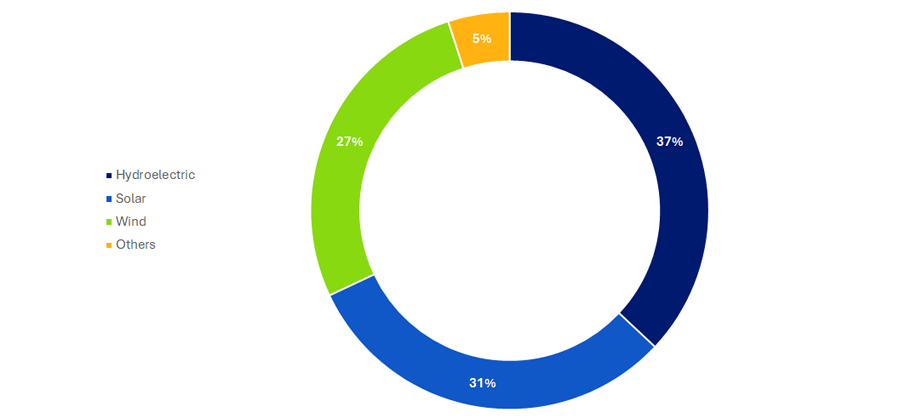

On the other hand, Italy, after ceasing nuclear energy production in 1987 following the Chernobyl disaster, heavily relies on fossil fuels, with natural gas representing 40% of its energy mix, followed by oil at 35%. This situation makes the country vulnerable to international market fluctuations and increases its dependence on energy imports, which accounted for nearly 80% of national consumption in 2021. Facing these challenges, Italy has set an ambitious goal: to significantly increase the share of renewable energies, aiming for 63% of electricity production by 2030. To achieve this, Italy has historically relied on hydroelectric power and is increasingly exploiting its solar and wind potential.

The energy supply mix in Italy in 2022

Installed renewable energy capacities in Italy by production mode in 2022

Higher and more volatile prices in Italy

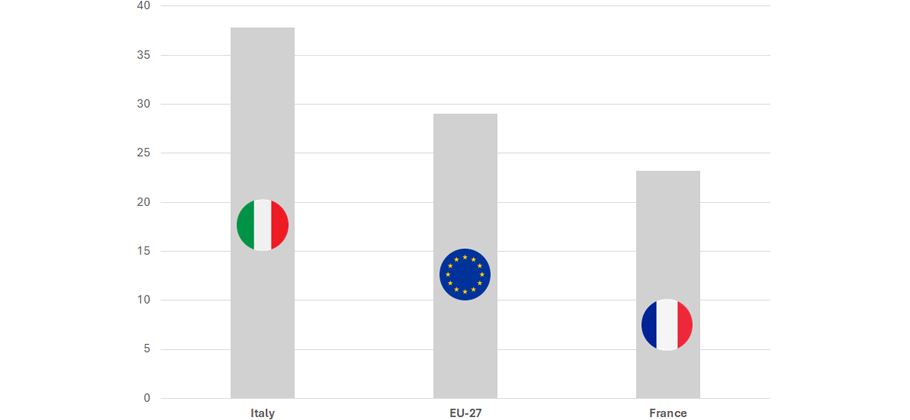

The pricing structure also varies between France and Italy. In France, the abundance of electricity produced by nuclear power allows historically low prices. The regulated tariff set by the state continues to serve as a reference, offering some stability to consumers. In 2023, the average electricity price for households was 23.17 c€/kWh, aligned with this regulated tariff.

In Italy, energy prices are higher and more volatile, due to the heavy dependence on imports. In 2023, the average electricity price for households was 37.82 c€/kWh. This volatility is mainly explained by fluctuations in gas prices on international markets, particularly related to geopolitical crises that can destabilize supply chains. The Italian regulatory authority (ARERA) thus faces difficulties in controlling tariffs, representing a risk to consumers.

Electricity Prices in 2023 (in euro cents per kilowatt-hour)

Similar populations, different consumption

Despite having similar populations, around 68 million inhabitants in France and 60 million in Italy, the energy consumption of both countries differs significantly. In 2022, France consumed 224.4 million tonnes of oil equivalent (Mtoe), while Italy consumed 145.3 Mtoe, about 55% less. This disparity is largely due to the predominance of electricity in the French energy mix, fueled by nuclear production, while Italy still relies heavily on fossil fuels, which are more efficient but also more polluting. Thus, France ranks as the second most energy-consuming country in Europe, just behind Germany, while Italy ranks fourth after the United Kingdom.

On the other hand, France’s carbon footprint is more favorable thanks to its less polluting energy mix. In 2022, France emitted about 4.7 tonnes of CO2 per capita, compared to 5.5 tonnes in Italy. This difference is an advantage for France, which is progressing more rapidly towards the carbon neutrality goals set by the European Union.

France:

- Energy consumption (in tonnes of oil equivalent per capita): 3.3

- CO2 emissions (in tonnes per capita): 4.7

Italy:

- Energy consumption (in tonnes of oil equivalent per capita): 2.4

- CO2 emissions (in tonnes per capita): 5.5

Conclusion: towards a common goal

Despite their differences, France and Italy share similar ambitions in terms of energy transition. The Enlit Europe forum, to be held in Milan in October 2024, will be a key event to discuss these issues and strengthen European cooperation. Both countries will need to combine their efforts to accelerate the transition to a decarbonized mix, while strengthening the resilience of their respective energy systems and actively promoting sobriety.

Datanumia, as a leading partner, is committed to supporting these transformations by providing energy suppliers with efficient tools. Our residential offer, “Home,” is the most comprehensive customer consumption monitoring platform on the market, enabling energy suppliers to help individual customers understand and manage their energy consumption, while contributing to the reduction of their carbon footprint.

Last news